Decode Camp Staff Burnout: The Camp Staff Experience Wheel

The Camp Experience Wheel: Measuring the Camp Staff Experience Imagine this: it’s mid-July, the sun is blazing, and your camp is in full swing. Campers […]

Get in touch with any product inquiries you may have and we’ll do our absolute best to answer your questions by the next business day.

Want to see how UltraCamp could be utilized for your exact needs and situation? The first step is to schedule a quick 15-minute call so we can understand your unique needs. Next, we'll create a demo tailored to your camp. It will look and feel like you’ve opened registration already.

I’m here to talk about ACH myths and clear up some confusion and mystery surrounding these transfers. I’ve got to be honest, I’m kinda excited! I’ve never debunked something before unless you count Lance Ordonez when he made the mistake of trying to sleep in my bed back at Camp Gilead.

I should start with a disclaimer: If you don’t know what I mean when I say ACH, you should read our blog post “What is ACH?”.

Alright, here are the top 5 myths about ACH Debunked!

OK, this one is easy, because it’s highly likely that they already do. If they’re paid by direct deposit, they use ACH. If they use apps like Venmo or Zelle, they use ACH. If they use their bank’s bill pay service, they use ACH. If they have their cable bill set to AutoPay, they use ACH. Heck, if they pay their credit card statement online or through the card’s app, THEY USE ACH.

I don’t know your parents, but I think you underestimate how comfortable they are with technology in their everyday life. I would agree they might balk at NEW technology, but it’s extremely unlikely that this is new to them. Your parents will be happy to use ACH, for these reasons plus one more: If you explain to your parents that their payment going through ACH vs a credit card helps support your camp and its mission, they will be only too happy to use that method. And for those still unwilling participants, they are likely paying you in gold doubloons from their secret cave, and who doesn’t love a good doubloon?

They run on largely similar systems. As ACH is federally regulated, all institutions utilizing it must adhere to the same set of standards set by the US government (just like credit cards). Those standards include encryption of all personal information. If your customers are comfortable with the security of a credit card, they can rest easy: a credit card transaction is no more or less secure than an ACH transaction.

Fraud occurs far more on credit cards than on ACH transactions, so you could make the case that ACH is more secure. I’ll prove it: Send me your credit card information (please include the expiration date and that 3 digit code on the back, it’s for science) and your bank account information (not just the account number, I need the routing number too, to make it fair) and we’ll see which one I take money from. I think you’ll be surprised; I really do.

Oh, bless your heart. ACH has been around since the 1970s, making it older than almost all your customers. Banks (the primary users of ACH) created this system in response to concerns that they soon would not keep up with the volume of paper checks passing through their institutions. Even the majority of physical checks written pass through the ACH system in what is called “electronic conversion”, and that’s been going on for almost 20 years.

Ever wonder why your bank statement (if you actually get one in the mail) doesn’t include all your canceled checks anymore? It’s because they were electronically converted. Sort of like Bitcoin, only in this case the result feels less like a water slide where you’re not completely sure if the pool at the bottom has water in it or not.

OK, now you’re just making stuff up. It’s the exact opposite! When your customers choose to pay with ACH rather than credit cards, they save you money on each transaction. Because ACH has fewer processing fees, it could save you thousands of dollars each year. I could spend a bunch of time here talking about how much you could save, but I’ll tell you what: I’ll do another post after this that shows a breakdown of some real-world examples and how much a camp could save if even a small percentage of their customers paid with ACH rather than credit cards.

Seriously, this myth is worse than the one about the scuba diver being picked up by the airplane and dropped on the forest fire (but that’s because that one is actually true. A guy that works with my brother’s friend knows the guy who used to work at the TIGFriday’s, and a lady that came in once said the scuba diver was someone that her mechanic was connected to on Friendster. I know! Creepy, right??)

And now the promised true rumor:

OK, this one is true. While the credit card processing results in you getting your money likely on the next business day, ACH transactions usually take 5-7 business days. Because credit card companies process their own transactions, while ACH transactions go through one of two clearinghouses, they take a bit longer. But let me ask you this: if you had the choice between getting punched in the face tomorrow and being given $300 in a few days, which would you choose? That’s what I thought.

Just admit it, you don’t know what you’re talking about. It’s super easy! If you’re an UltraCamp customer, just go to the My Settings Wizard and open the Client Payments tab. Click on ACH and change it to “Yes, I’d like to accept ACH” and start your application. If you’re not yet an UltraCamp customer, let’s start the conversation there. We’d love to talk with you and learn more about you and your organization.

The Camp Experience Wheel: Measuring the Camp Staff Experience Imagine this: it’s mid-July, the sun is blazing, and your camp is in full swing. Campers […]

Here are some fun activities and icebreakers perfect for the first day of camp! Mix these games in while going over the camp rules, and […]

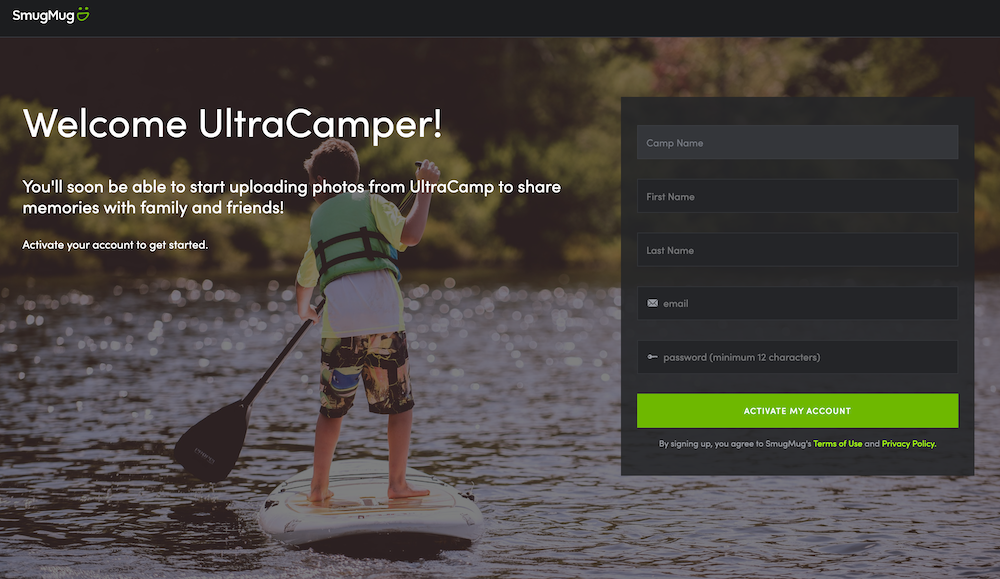

UltraCamp has partnered with SmugMug, the leading photo sharing service, to bring you a fantastic new photo gallery integration. This new feature will make managing and […]

Subscribe to our newsletter for helpful camp tips & tricks

UltraCamp customer support is limited to camp administrators only. If you are not an administrator, please contact your camp or organization directly for assistance.